When you first went freelance you likely heard horror stories about having to wait for months for your work to be published so that you could finally get paid for it. Other freelancers told you all about that time they had to hound a client like crazy to get them to pay for work that had been completed. You were prepared for that. You were prepared for potential clients to convince you that you should work for “exposure,” and to have to work your way up to the big publications and really well-paying work.

What you weren’t prepared for were taxes.

People tend to skate over just how important it is for freelancers to stay on top of their taxes. They gloss over the fact that freelancers are now responsible for their entire tax burden as opposed to when they were employees and their employers paid some of it for them. They mention estimated tax payments like they are optional (they aren’t). It’s no wonder that when you sit down to figure it out, it seems overwhelming.

Here are the basic facts that you need to know about being a freelancer and dealing with taxes.

Essential Freelance Tax Tips

Taxes are More Complicated When You Do Them Yourself

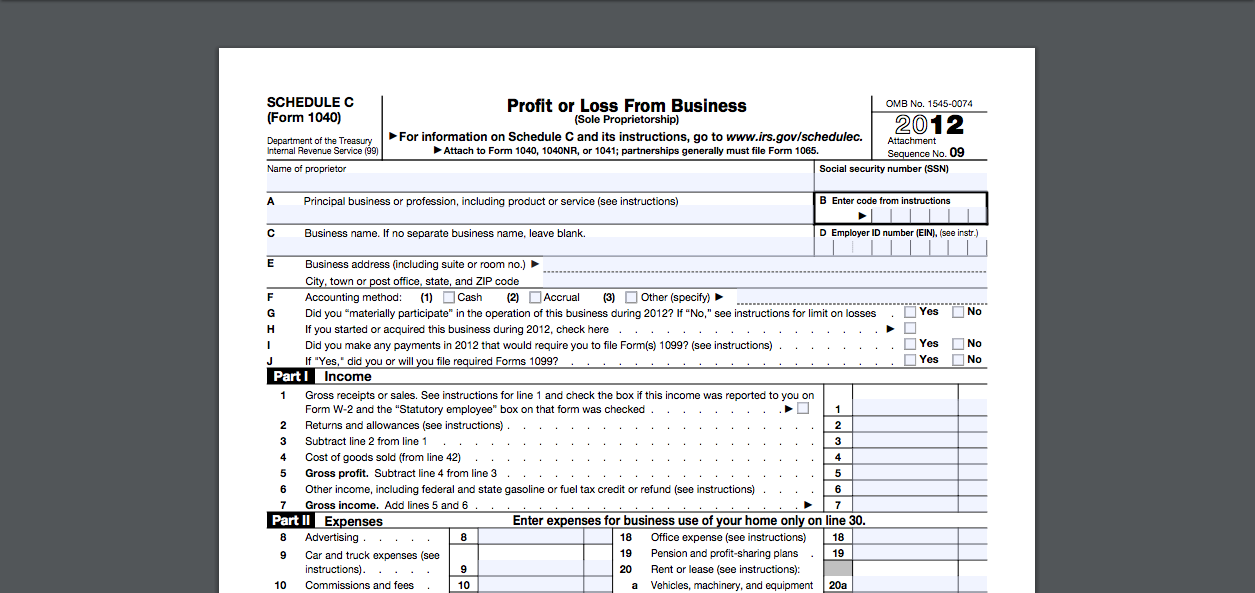

Wave goodbye to the 1040 EZ. Those days are over for you. Now your life is a 1040/Schedule C situation. The good news is that a lot of the supplies and tools you use to build your freelance business–including part of your utility payments and rent/mortgage (if you work out of your home)–can be used to reduce your tax burden. In order to claim them, though, you need to be able to itemize them and account for them if someone asks. This means not just tracking every penny you spend, but where you spend it.

Automate As Much As Possible

Some of you reading this are likely Type As who prefer to manage all of the minutiae yourselves. That’s fine. Even so, there are some things you can do to streamline your finance reporting. For example, use an app to record all of your receipts as soon as you get them. This way if you lose one or its ink evaporates, you’re still covered.

It’s also a good idea, say the experts who developed the MasterTax payroll tax software, to use government compliant software for your financial ledger. This way, as you enter your incoming and outgoing payments you can mark them using the tax codes you’ll need for your annual returns. This makes them easily searchable and identifiable at tax time.

Estimated Tax and Withholding

As a freelancer, you are 100% responsible for your own tax filing and tax payments. And unlike the setup when you were an employee and only had to deal with taxes once a year, as a freelancer, you’ll have to make payments at least quarterly.

Related: Keep a Healthy Balance Sheet With This Freelance Tax 2016 Guide

There are several schools of thought on how to approach this. The IRS bases what they think you should be paying each quarter on your total sales for the previous year. Then, if you earn more this year, you simply pay the difference when you file the return. But what if you’re in your first year? In your first year, a good rule of thumb is to set aside at least 20-30% of your income for your federal tax payments and around 10% for state. Keep these funds in a separate account so you won’t be tempted to spend them.

Traditionally, estimated tax payments are paid quarterly. If that’s your preference, that’s fine. You can also pay more often if that seems easier to you. Perhaps you’d rather just send that money to the IRS every time you get paid. You can do this using the digital EFTPS system offered by the IRS (which is how you will also pay any outstanding taxes). Keep the receipts for each payment though because you’ll need that information when it’s time for your annual filing.

The best way to keep track of all of this is to simply get into the habit of recording everything as soon as it happens. If you’re strapped for time, carve out a block of time every day or every week (never go longer than a week or you’ll get buried). Record everything and then file it properly away. You’ll be amazed at how much easier it is to do your taxes (or find the info you need to send to your accountant) come tax season.

Leave a Reply